Do you know that India is the leading country with 25.5 billion real-time payment transactions? Keep reading to know more.

India has been the leading market in terms of digital payments since 2019. The use of digital payments in India has grown considerably, especially after the pandemic, which forced people to stay indoors and order food and other items through online platforms.

According to Ministry of Electronics and IT, a total of 7,422 crore digital payment transactions were recorded during FY 2021-22, up from 5,554 crore transactions seen in FY 2020-21.

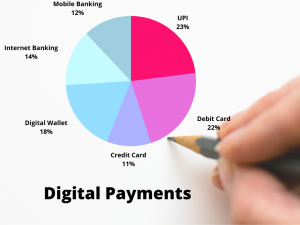

In a survey taken in 2020, the preferred modes of Digital Payments across India;

Among the different modes of payments, QR based payments is rapidly picking up pace, especially after demonetisation phase. One can simply scan a QR code to pay utility bills, fuel, grocery, food, travel and several other categories. Data loss and security breach is minimized since the user only scans the QR.

Benefits of Offering Online Payments:

- Saves Time

- Reduces Need for Cash

- Easier to Manage

- Secure and Reliable

- Low Risk of Theft

- Saves Money

- Reduces Labour

- Attracts More Customers

- Offers Better Customer Experience

- Quick and Easy Setup

- Creates Trust for The Customer

- Decreases Late Payments

- Recurring Payment Capabilities

- Accepts a Wide Variety of Payments

- Immediate Confirmation

- Convenient Storage of Data

- Metric Viewing Capabilities

Almost 80% of the customers go for online payments than Cash on Delivery.

“Ignoring any of the payment modes means ignoring your customer’s need and ignoring the customer’s need is ignoring the nerve of business.”

The Bottom Line

Society is going non-cash, and so should your business.

Consider embracing the technology and implementing it before your competitors do – and enjoy the flow of incoming loyal customers.